Financial

& Insurance

Clarity-driven, user-first software.

We create user-ready banking and insurance products.

From digital banking fronts, credit-scoring platforms, digital onboarding/eKYC, to crowdfunding, and claims-settlement portals.

We support the full product life cycle:

We support the full product life cycle:

Why Partner With Us

Truly user-centric.

Clean UIs, clear flows, purposeful micro-interactions, and UX writing that guides people through key tasks.

Prototypes in weeks.

Clickable mockups and quick user tests to validate before we code.

Seamless integrations. Zero headaches.

Credit scoring, payment services, ERPs/CRMs, and external APIs.

One team, all-in.

Product, design, frontend, backend, QA, and data working as one squad.

Straightforward governance.

Agile sprints, live demos, transparent boards—always know what’s next.

We deliver

What it matters

Impact Snapshots

Challenge

- Banking web app felt complex and confusing.

- Upfront credit check.

- Slow, in-person account openings.

- Financing projects with many contributors.

- Manual insurance claims handling.

Our digital response

- Digital banking frontend with transfers, balances, and history; clear navigation, helpful empty states, and instant feedback to reduce friction and support tickets.

- Credit-scoring–integrated platform for pre-qualification and origination, with business-editable rules.

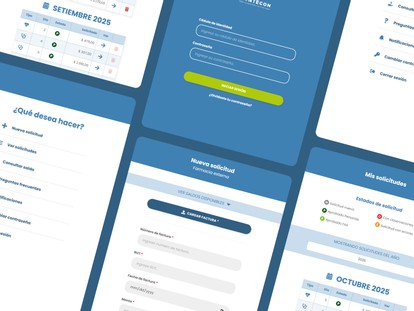

- Digital onboarding and e-KYC that enables 100% online sign-ups with step-by-step guidance.

- Crowdfunding platform with campaign publishing, payment gateway, and dashboards for creators and back-office.

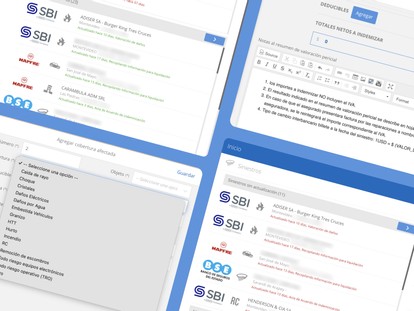

- Claims-settlement portal for insurers: case intake, document upload, state tracking, and operational dashboards.

Featured

Case studies

-

ABCN

Transforming Claims Management: a unified, auditable, and scalable platform

A comprehensive claims management platform for loss adjusters with insurer portals and full traceability. -

Montecon

Frictionless Reimbursements for a Health Insurance

Digital transformation of health reimbursement flows for maritime workers.

What we can build from Idea to Product—Together

- Digital banking frontends (web & mobile): transfers, balances, movements, receipts, notifications.

- Platforms with integrated credit scoring for pre-approval and origination.

- Claims-settlement portals for insurers: policyholder, provider, and back-office views.

- Operational and business dashboards: usage, conversion, and service health.

- Digital onboarding and e-KYC (high-level)

- Crowdfunding & investment: campaigns, contributions, performance dashboards.

- Mobile apps for self-service and real-time notifications.

- APIs and back-office tools for internal teams and partners.

How We Work

-

01. Discovery with a user lens.

Short interviews, journey mapping, and definition of the critical use cases.

-

02. Rapid prototyping.

Figma + usability tests to validate wording, flows, and components before development.

-

03. Design System.

A consistent, accessible UI library that's easy to maintain.

-

04. Continuous delivery.

Agile cycles with demos and visible metrics (adoption, step-by-step conversion, task time).

-

05. Ongoing evolution.

Quarterly roadmaps to keep iterating on the highest-value areas.

Our UI/UX focus sets us apart.

Clarity first—clean visual hierarchy, readable typography, and helpful error states that guide recovery. Intentional micro-interactions provide instant feedback on critical actions (transfer, confirm, attach) so users always know what’s happening.

UX writing keeps copy short and concrete to reduce confusion and drop-off. And we prioritize accessibility and performance—fast loads and accessible components—so more users succeed in more contexts.

View Our Full Portfolio