Designed to transform management in the insurance sector, our system meets the needs of adjuster firms seeking to standardize and accelerate their processes, insurers and reinsurers requiring greater visibility, document consistency, and traceability at every stage, and brokers or claims departments handling high volumes of cases with multiple templates and regulatory requirements.

Transforming Claims Management: a unified, auditable, and scalable platform

A comprehensive claims management platform for loss adjusters with insurer portals and full traceability

The Client

A loss-adjusting firm with decades of experience serving multiple insurers needed to modernize its end-to-end operation. With high document volume and strict formal outputs, the team wanted a single platform—global and extensible—to standardize the process, cut cycle times and errors, and give insurers a private portal to check their claims and download reports without back-and-forth emails.

The Challenge

The full flow—intake, inspection, valuation, liquidation, agreements, closure—was scattered across spreadsheets, emails, and insurer-specific formats. That fragmentation caused delays, rework, and limited pipeline visibility. Each insurer demanded its own PDF templates, and the firm needed fine-grained traceability (who changed what, when) plus deadline alerts and an auditable history.

The Solution

Tech stack used:

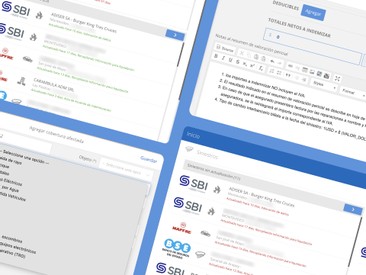

We designed and built a web claims platform focused on productivity and control, with a clean UI that works for power users and newcomers alike. The claim file is organized into modular "chapters" that automatically feed the official reports.

- Frictionless UX: fast tables with sort/filter, guided editing, inline validation, and 1-click PDF generation

- Parametric PDFs per insurer: Liquidation, History, Agreement Acts, and more—totals, deductibles, and legal text are auto-generated

- Checklist & operational agenda: stage-by-stage progress, call/email logs, and time-stamped actions

- Due-date alerts: email notifications for critical milestones

- Insurer Portal: authenticated access to each insurer's claims with self-serve report downloads

- Full traceability: comprehensive audit log down to field-level changes and attachments

- Multi-currency: calculations and reports in USD and local currency

- 100% historical migration: all legacy Excel data was normalized and imported

- Roles & permissions: handlers, adjusters, supervisors, and admins with tailored views and actions

See it in action

Created for the future of finance.

Testimonials

"We went from chasing files and versions, to making decisions."

Reports are out in minutes, control is absolute, and our clients feel it—everything is available in their portal. This platform changed our firm's pace.

Key Differentiators

Next Steps

Ready to see it in action?

Or do you have a specific challenge in your financial practice or institution?

Let’s talk